Bankruptcy Victoria Fundamentals Explained

Table of ContentsThe Greatest Guide To File For BankruptcyThe Main Principles Of Liquidation Melbourne Things about Bankruptcy6 Easy Facts About Bankruptcy Melbourne ExplainedBankruptcy - An Overview

As Kibler said, a company requires to have a really good factor to rearrange a good factor to exist as well as the increase of ecommerce has actually made merchants with large shop visibilities out-of-date. Second chances may be a beloved American suitable, yet so is technology and also the growing pains that come with it.Are you staring down the barrel of declaring on your own insolvent in Australia? This is no justification for someone leading you down the path of stating personal bankruptcy.

We comprehend that every person faces monetary stress eventually in their lives. In Australia, also households as well as services that appear to be thriving can experience unforeseen challenge due to life modifications, work loss, or elements that run out our control. That's why, right here at Obtain Out of Financial Debt Today, we offer you professional advice and also assessments regarding the real repercussions of personal bankruptcy, debt arrangements as well as other monetary concerns - we desire you to obtain back on your feet and also remain there with the finest feasible outcome for your future and all that you want to acquire.

More About Insolvency Melbourne

It deserves keeping in mind that when it concerns financial obligation in Australia you are not the only one. Individual personal bankruptcies and insolvencies go to a document high in Australia, impacting three times as lots of Australian contrasted to twenty years earlier. There is, nevertheless, no safety in numbers when it involves proclaiming bankruptcy and bankruptcy.

Something that numerous Australian people are unaware of is that in real reality you will be noted on the Australian NPII for simply lodging an application for a debt agreement - Personal Insolvency. Lodging a debt contract is really an act of declaring yourself insolvent. This is a main act of insolvency in the eyes of Australian legislation even if your debt collection agencies do decline it.

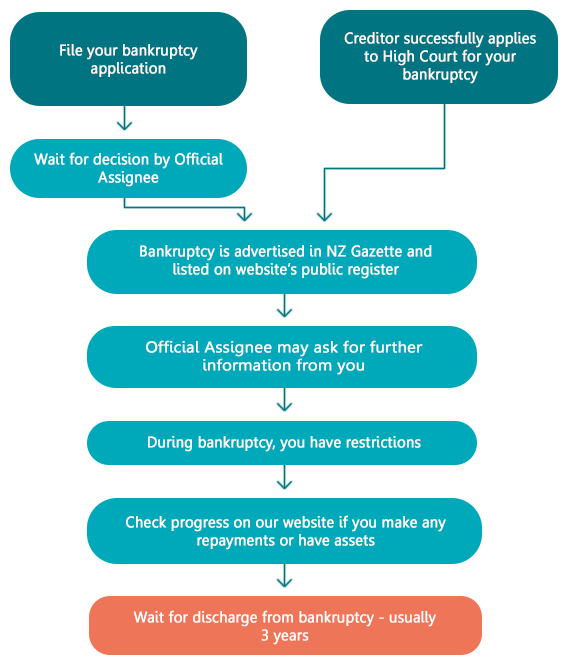

During and after your personal bankruptcy in Australia, you have particular commitments and deal with certain constraints. Any type of lenders that are wanting to get a copy of your credit record can request this information from a credit report coverage firm. When you are proclaimed insolvent secured financial institutions, who hold safety and security over your residential property, will likely be qualified to take the home and market it.

Personal Insolvency Things To Know Before You Buy

a residence or automobile) As soon as stated bankrupt you should notify the trustee instantly if you become the recipient of a departed estate If any of your creditors hold legitimate security over any property and they take activity to recover it, you must help You must surrender your passport to the trustee if you are asked to do so You will certainly continue to be accountable for debts sustained after the day of your insolvency You will will not have the ability to act as a supervisor or manager of a business without the courts permission As you can see entering right into bankruptcy can have lengthy lasting unfavorable results on your life.

Becoming part of personal bankruptcy can leave your life in tatters, shedding your house as well as anonymous properties and leaving you with absolutely nothing. Avoid this result by speaking with a financial obligation counsellor today regarding taking a various rout. Personal bankruptcy requires to be properly considered and intended, you should not ever go into bankruptcy on a whim as it can take on you that you might not also understand. Bankrupt Melbourne.

We give you the ability to pay your financial obligation off at a lowered rate as well as with reduced interest. We understand what financial institutions are trying to find as well as are able to negotiate with them to give you the best possibility to pay off your debts.

Bankruptcy Melbourne Things To Know Before You Buy

What is the difference between default and also personal bankruptcy? Defaulting on a lending implies that you have actually violated the promissory or cardholder contract with the loan provider to make payments on time.

How File For Bankruptcy can Save You Time, Stress, and Money.

For circumstances, if you back-pedal an automobile loan, the loan provider will usually attempt to reclaim the car. Unsecured financial debt, like bank card financial obligation, has no security; in these situations, it's more difficult for a debt collection agency to recover the financial debt, however the firm may still take you to court and attempt to put a lien on your home or garnish your incomes.

The court will certainly appoint a trustee that might sell off or offer several of your ownerships to pay your financial institutions. While most of your financial obligation will be canceled, you might pick to pay some lenders in order to maintain an auto or house on which the creditor has a lien, claims Ross (Bankruptcy Australia).

If you operate in an industry where companies check your credit scores as component of the hiring procedure, it may be a lot more difficult to get a new job or be promoted after bankruptcy. Jay Fleischman of Money Wise Law states that if you have credit history cards, they will certainly generally be closed as soon as you file for bankruptcy.