The Main Principles Of Insolvency Melbourne

Table of ContentsAn Unbiased View of Bankruptcy AustraliaAn Unbiased View of Bankrupt MelbourneFascination About Bankruptcy MelbourneThings about Bankruptcy Advice MelbourneGetting My Bankruptcy Melbourne To Work

You'll then have time to deal with the court and your lenders to identify the following actions. Will I Lose My Property? What takes place to your home relies on whether you submit phase 7 or chapter 13 insolvency. If you're not exactly sure which alternative is ideal for your circumstance, see "Insolvency: Phase 7 vs.Chapter 7Chapter 7 personal bankruptcy is usually called liquidation personal bankruptcy due to the fact that you will likely need to liquidate several of your possessions to satisfy at the very least a portion of what you owe. That said, state regulations establish that some assets, such as your pension, house as well as auto, are excluded from liquidation.

Bankruptcy Melbourne Fundamentals Explained

Phase 13With a phase 13 insolvency, you do not need to bother with requiring to sell any of your residential or commercial property to please your financial obligations. Rather, your financial debts will be restructured to ensure that you can pay them off partially or completely over the next three to five years. Bear in mind, however, that if you do not abide with the layaway plan, your creditors might have the ability to go after your properties to please your debts.

That stated, the 2 kinds of bankruptcy aren't treated the very same way. Since phase 7 insolvency completely gets rid of the debts you consist of when you submit, it can remain on your credit scores record for approximately 10 years. While chapter 13 insolvency is likewise not optimal from a credit report viewpoint, its configuration is watched even more positively since you are still paying off a minimum of a few of your financial debt, and also it will certainly remain on your credit history report for approximately 7 years.

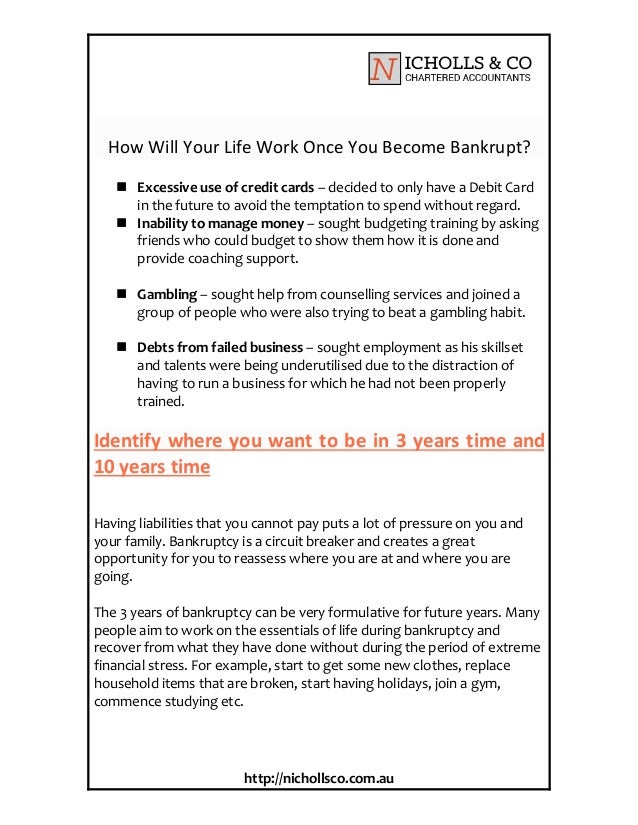

There are some lenders, nonetheless, who specifically deal with individuals who have actually undergone insolvency or other challenging credit score occasions, so your choices aren't completely gone. The credit scores scoring models favor brand-new details over old information. With positive credit score habits post-bankruptcy, your credit rating can recuperate over time, also while the personal bankruptcy is still on your debt record.

The 15-Second Trick For Bankruptcy Australia

For the a lot of component, it's even more typical for attorneys and lenders to use this system to look up details about your bankruptcy. Anybody can register and also examine if they want to.

It can additionally help those with inadequate or limited credit scores situations. Various other solutions such as credit scores repair work may cost you up to thousands as well as just assist remove errors from your debt record.

Bankruptcy is a legal procedure where somebody who can not pay their debts can obtain relief from a commitment to pay some or all of their debts. You must get aid from a monetary therapy service as well as lawful advice before applying for bankruptcy. Coming to be insolvent has serious effects and there might be other alternatives readily available to you.

An Unbiased View of Liquidation Melbourne

AFSA has information about your obligations while insolvent. There are severe consequences to coming to be insolvent, including: your insolvency being permanently tape-recorded on the your insolvency being noted on your credit score report for 5 years any possessions, which are not shielded, possibly being sold not having the ability to take a trip overseas without the created approval of the personal bankruptcy trustee not being able to hold the position of a director of a company not having the ability to hold certain public placements being restricted or stopped from proceeding in some trades or careers your ability to obtain money or get things on credit being impacted your capacity to get rental holiday accommodation your capacity to get some insurance policy contracts your capacity to access some services such as energies and telecommunication solutions.

You're allowed to maintain some assets when you become bankrupt. These consist of: many household items devices redirected here utilized to make a revenue up to an indexed amount automobiles where the total equity of the vehicle is much less than an indexed quantity most controlled superannuation equilibriums and also the majority basics of settlements got from superannuation funds after you go bankrupt (superannuation you withdraw from your superannuation account before you go insolvent are not safeguarded) life insurance policy plans for you or your partner and also any kind of profits from these policies gotten after your insolvency payment for an accident (eg injury from a vehicle mishap) as well as any type of assets got with this payment properties held by you in count on for a person else (eg a child's savings account) honors or prizes which have emotional worth (if lenders concur).

It is really crucial to get lawful guidance before filing for personal bankruptcy if you own a home. Debts you must pay regardless of insolvency You will still have to pay some debts even though you have become insolvent.

The Best Strategy To Use For Insolvency Melbourne

These include: court penalized and also fines maintenance financial obligations (including youngster assistance debts) student assistance or supplement finances (HELP Greater Education And Learning Finance Program, HECS Higher Education And Learning Payment System, SFSS Pupil Financial Supplement Scheme) financial obligations you sustain after you become bankrupt unliquidated debts (eg auto accidents) where the quantity payable for the damage hasn't been dealt with before the day of bankruptcythere are some exemptions financial obligations sustained by fraud financial debts you're reliant pay because of wrongdoing (eg settlement for injury) where the total up to be paid has actually not yet been dealt with (unliquidated bankruptcy lawyer queens problems)there are some exceptions to this.

It does not matter if you're bankrupt at the beginning or end up being insolvent during the situation. You ought to tell the court, as well as everybody entailed in your instance if you're insolvent or in an individual insolvency arrangement.